Petronas Post 50% JUMP in Net Profit

For its year ended March 31 2005, Petronas returned RM31 billion to the Government, 47% higher compared with the last year. Since its incorporation, Petronas is reported to have paid the government a total of RM246 billion. During its last financial year, too, Petronas subsidised some RM6 billion for natural gas supplied to Malaysia's power sector.

The RM31.2 billion Petronas paid the Government include corporate taxes, royalties, export duty and dividends.

Petronas revenue hit a record RM137 billion, a 40.5 per cent increase from RM97.5 billion registered last year.

Of the RM137 billion in revenue, revenue from exploration and production rose 51.5% to RM31.3 billion; from oil it climbed 34.7% to RM51.4 billion; and, from gas it leapt 26.9% to RM26.7 billion. Revenue from petrochemicals also rose 51.6% to RM12 billion while logistics and maritime revenue was up 59.4% at RM8.1 billion with property revenue up 73.5% to RM5.6 billion. The balance comprised revenue from a wide range of other sources.

Petronas group’s total assets stands at RM239.1 billion, up 17.7 per cent from RM203.2 billion last year.

Petronas net profit for the year ended March 31 2005 is RM35.55 billion, the highest in its 30-year history on the back of a sharp spike in world oil prices. Petronas posted RM23.66 billion profit in the last financial year, which means it has increase of 50% profit margin.

So, RM31.2 billion was paid the Government which is 47% higher in taxes as compared to last year. That means, the government is receiving an additional of RM14 billion in revenue, a direct contribution from the increase in the price from crude oil.

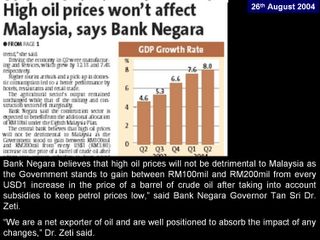

Zeti

According to Zeti, the Bank Negara governor, a US$1 increase in global oil prices will positively impact the Government by RM100 million to RM200 million."

So, by mathematical analysis, if the price of crude oil now is USD60, and the previous comparative level is USD26, then the price increase will mathematically be USD34 and the additional gain by the government should be RM6.8 billion (based on Zeti's assumption of RM200 million for every dollar global oil price increase).

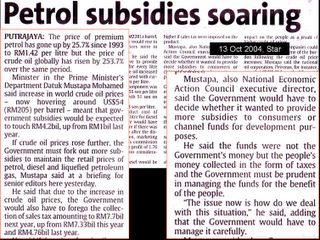

Mustapa Mohamed

According to the statement from the Minister in the Prime Minister's Department, Datuk Mustafa Mohammad (October 13, 2004, The Star; "Petrol Subsidies soaring"), if the price of crude oil stays at USD54, the government subsidies for fuel had increase to RM4.6bil from RM1 bil (when the price was USD26 in 2003). If the price of crude is USD60, then based on RM1.52 per litre of premium petrol, the subsidies will amount to no more than RM4 bil.

At such, even as the crude oil price is USD60, taking into consideration that Petronas alone had paid an additional of RM14bil in taxes, minus the subsidy of RM4 bil, the government is a net gainer of RM10 bil, solely from the taxes from Petronas. If we are to include the foreign oil and oil related companies additional taxes, the net additional gain is much, much higher.

So, is there a reason to increase the price of fuel?

Coming back to Petronas claim that they had contributed RM31 bil in taxes, duties, royalties and dividends, and a total RM246 bil contribution to the government over the last three decades, the question of subsidies becomes a paranoia.

Some quarters have asked why the highly-profitable national oil corporation cannot be asked to extend the subsidies instead.

Public opinions has being that Petronas, as a responsible corporate citizen, and being a net billion dollar gainer of the huge price increase from crude oil, should consider making substantial contributions towards assisting the government in the fuel subsidies, Petronas president and CEO, Tan Sri Mohd Hassan Marican said the national oil corporation should not be expected to subsidise petrol and diesel prices.

"Petronas should not be penalised for its success. We should be proud that a Malaysian company has gone this far," Hassan Marican said.

Hassan said Petronas has fulfilled its financial obligations to its shareholder [by contributing RM31 billion in taxes], the Government of Malaysia.

According to Hassan Marican, Petronas is not the only player in the domestic products retail market and it would be unfair for Petronas, which holds only a 30 per cent market share, to subsidise petrol and diesel prices as it would mean that it is subsidising all the other domestic fuel oil companies. Requiring the other oil companies in Malaysia to also subsidise prices of petrol and diesel would likewise be unfair as it would eat up the already slim margin they are making under the Automatic Pricing Mechanism. Worse still, it may drive the companies out of Malaysia and cripple the country's petroleum products retail system.

Mohd Hassan said as a business entity, imposing additional burden of subsidising petrol and diesel prices may have serious implications on international investors' confidence in Petronas. It may result in downgrading of the oil company's ratings by international rating agencies, he added.

Can we agree with the profound reasons propounded by the CEO and President?

eh.....oh!!!!!

The government has proven once too often that downgrading of international rating is not a concern to the nation, what more to Petronas.

During the economic crisis in 1997, the nation's economic position was even downgraded to junk status.The then government headed by Tun Mahathir doesn't even sneeze. In fact, rumours at that time was that Petronas had been used to bail out several corporations and failed financial institutions, including banks, Bank Bumiputra, Proton, Perwaja, etc, etc... and Petronas rating was downgraded rapidly; Petronas Chairman, CEO and President said nothing of it.

No comments:

Post a Comment